Your Options When Shopping for Insurance - Our Independent Advantage

With so many options for finding insurance these days it can be hard to know the best place to look. We’ll look at the pros and cons of working with us compared to a few other options on the market today. Everyone offers savings but few can back them up with exceptional lifelong service regardless of the specific insurance company your policy is placed with.

Working with Nashville Insurance Services, an Independent Insurance Agency

An independent agency is an insurance agency that offers products from multiple insurance companies without preference to any one company. There are thousands of both regional and national insurance companies in the US, many of which offer their products exclusively through the independent agency channel. They compete with the large companies (with huge advertising budgets), by offering significantly lower rates to certain target markets of applicants or drivers. For example, one company may have the cheapest insurance rates for drivers with a clean record, while another might have the cheapest insurance rates for drivers with speeding tickets or at-fault accidents. An independent agency is able to partner with a number of these insurance companies to offer you the best rate for your specific situation.

Pros:

You only have to provide your information to one agency and we will shop for quotes from all of our partner companies on your behalf. Making it more likely that you’ll save money with us.

If this is your first time buying auto insurance, or if you’ve had a lapse in coverage, your insurance will be more expensive for the first 6-months. But once you’ve had 6-months of continuous insurance, you’ll be eligible for insurance with less expensive companies. We will be able to re-quote and move you into a less expensive company without you having to shop around again 6-months later.

If your insurance company cancels or non-renews your policy, we can likely find you coverage with another one of our partner companies, so you can continue working with the same agent, even though you are now insured with a new company.

We have the ability to find competitive rates for drivers and risks that most insurance companies would not accept.

If you have an unsatisfactory claims experience with your company, your agent can advocate on your behalf to make sure you are made whole again in a timely manner.

If your premium increases at renewal, your agent can re-quote you with their other companies to make sure you are still getting the best rate. You likely won’t have to reduce your coverage or find another agent to lower your premium to prior levels or lower.

You will have a dedicated insurance expert that knows your individual situation and will make sure you are adequately protected in all stages of your life.

If your rates go up and you would like to shop for a cheaper rate you can request that your agent/advisor take care of it and you won’t have to worry about sharing your personal information with another agency or spending time going through the shopping process again.

The competitive advantage of having so many companies sometimes allows us to offer you better coverage than your previous company for a lower price.

If you need service for your policy you can reach your agent/advisor directly without having to struggle through the maze of voice attendants and long hold times.

Many of the insurance companies that work with independent agencies have technology on-par with the major advertising brands.

Cons:

Many independent agencies charge fees for their services. Fortunately, Nashville Insurance Services does not. See our FAQ to learn more about our No-Fee Guarantee.

Because there is a significant amount of legwork in quoting with multiple insurance companies, it could take 1-2 business days to go from submitting an application to purchasing the policy. Pro-tip: Many insurance companies offer a discount for quoting ahead of time, so it is best to start shopping at least one week before you need coverage.

You won’t be able to quote and purchase online without speaking to an agent/advisor. Having an insurance expert go over your policy and make sure you are adequately protected is important. Much like you wouldn’t make a major health decision after diagnosing yourself on WebMD, you shouldn’t put your financial future in the hands of a general recommendation from an insurance website.

Not all independent agencies are equal, some have more partner companies than others. Many companies are relatively exclusive and will only work with a small number of reputable agencies. We have a great network of exclusive insurance companies and we’re confident that at least one of them will offer you a better rate than you are paying with your current company. For more information on our network of insurance companies, click here.

Going through a Captive Agency

A captive agency is an insurance agency that can only offer the products of one specific company. The most common examples of these are companies that have high advertising budgets and have local name brand offices. While their brand awareness is very high they’re not necessarily your least expensive option

Pros:

High brand awareness

Local agent that values your business and knows your financial situation

Cons:

Uncommon for one of these companies to be your least expensive option, they may offer less coverage than you currently have in order to offer “savings”

You’ll only receive a quote from one company so the only way to find a better price for your budget is to reduce coverage or increase deductibles

If you would like to receive quotes from other companies you would have to call other agencies and share your personal information with more people

If the company cancels or non-renews your policy because of an accident or violation, you will have to find a new agency to work with to find insurance

If your premium increases at renewal you will have to work with another agency or reduce coverage to decrease your rate to what you used to pay

Buying directly from an insurance company online

These are insurance companies that allow you to visit their website, quote yourself and buy your insurance policy online instantly.

Pros:

Intuitive technology and fast quotes.

Cons:

You will have to fill out a separate quote form for each online company you get a quote with.

Unlikely you will get the best rate even if you quote with multiple companies because they represent a small number of the options available.

Your coverage will not be personally tailored to your financial situation and you will likely purchase significantly less coverage than you should have.

Many recommend state minimum coverage because it is only slightly less expensive for you but the insurance company will have to pay out significantly less in case of an accident.

If you have a bad claims experience you don’t have a dedicated agent/advisor to advocate on your behalf.

If you need to call for service you will likely have to go through the maze of automated voice attendants and long hold times.

You will have to do extensive research on what types of coverage and limits you will need to adequately protect your financial future.

If your policy is cancelled or non-renewed because of an accident or violation you will need to go through the insurance shopping process again with other companies.

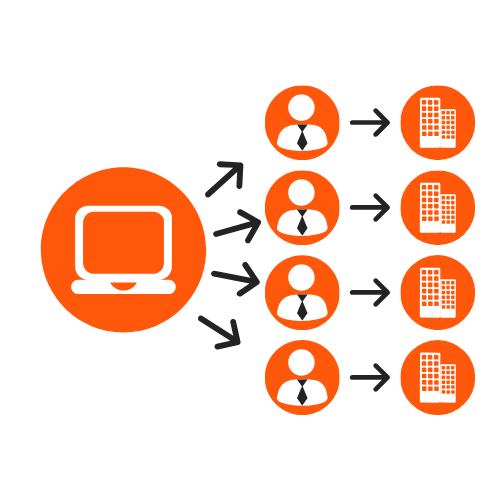

Going through “Compare Quotes Online” sites that sell your information

Many sites today promise to compare your quotes with multiple companies instantly to find you the best price are actually lead generation sources for multiple insurance agents willing to pay for your information.

Pros:

You will receive quotes from multiple insurance companies but you won’t be able to purchase them through the site.

Cons:

Many of these are lead generation tools, so instead of them providing you quotes directly, they sell your information to multiple insurance agents who will try to earn your business.

Because these agents know they are competing with others who bought your information they could recommend less coverage than you need to protect your financial future in an effort to have the lowest price.

If you purchase from one of these agents, you could continue to receive calls and emails from the others who purchased your information.

Many of the agents that purchase these leads are captive agents with a single company, which we will discuss further below.